Evolution of the business

+2.3 million new credit cards, 16.4% more than in 2022.

Total Performing Portfolio

(billion pesos)

Mortgage Portfolio

(billion pesos)

Bank Deposits

(billion pesos)

75% of the commercial loan portfolio corresponds to the corporate segment segment and 25% to the government and financial institutions segments.

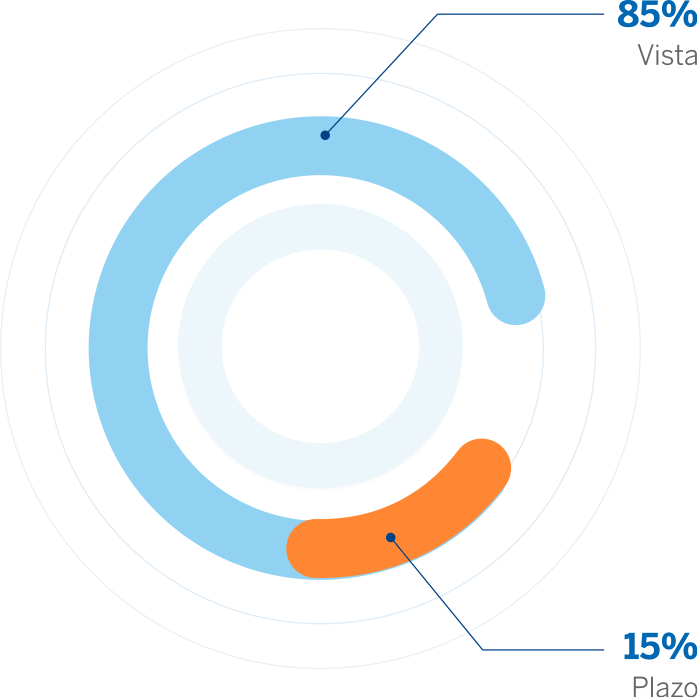

Composition of Bank Deposits

(%)