Corporate Governance

As the central support of Grupo Financiero BBVA México, the governance system seeks to integrate the principles, regulatory compliance, and financial and non-financial risk management, for the implementation of sustainability practices that are transversal in all the organization’s activities.

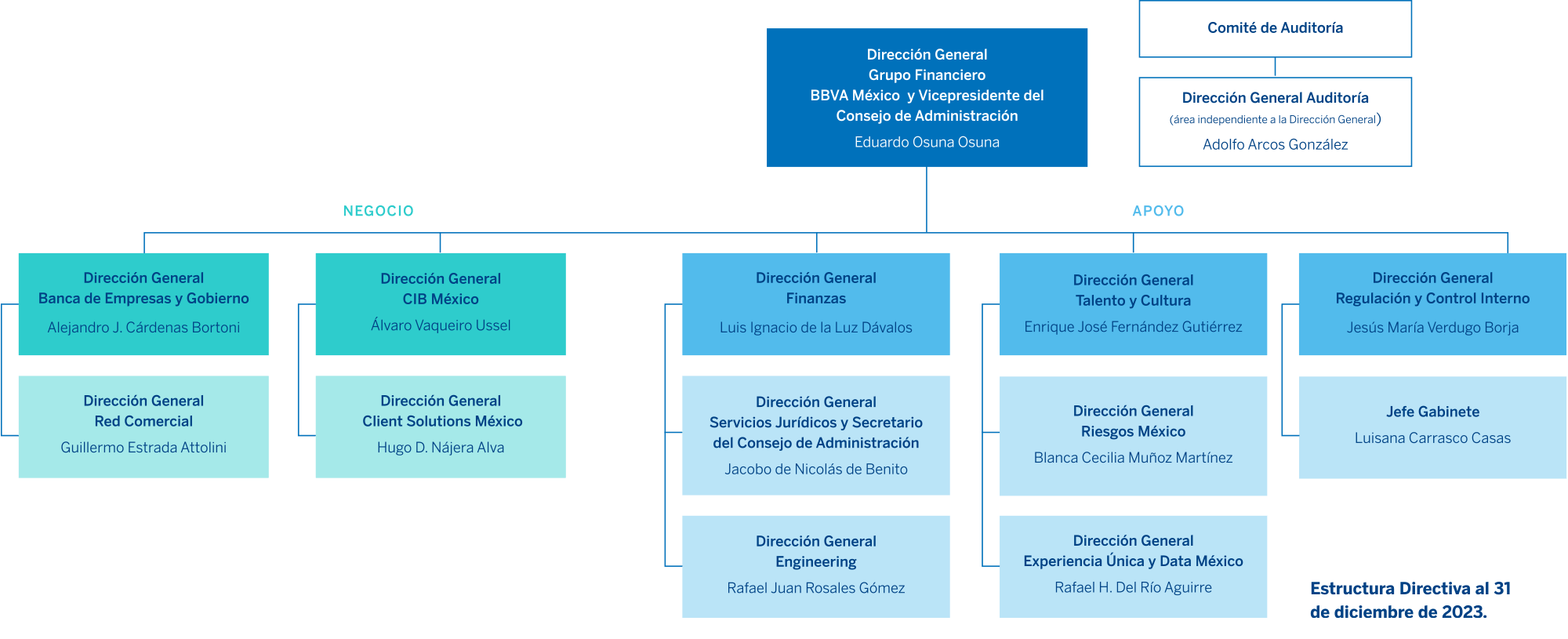

Management Structure

The management team of Grupo Financiero BBVA México is responsible for decision making, as well as for the implementation and monitoring of processes to ensure the smooth operation of the Group.

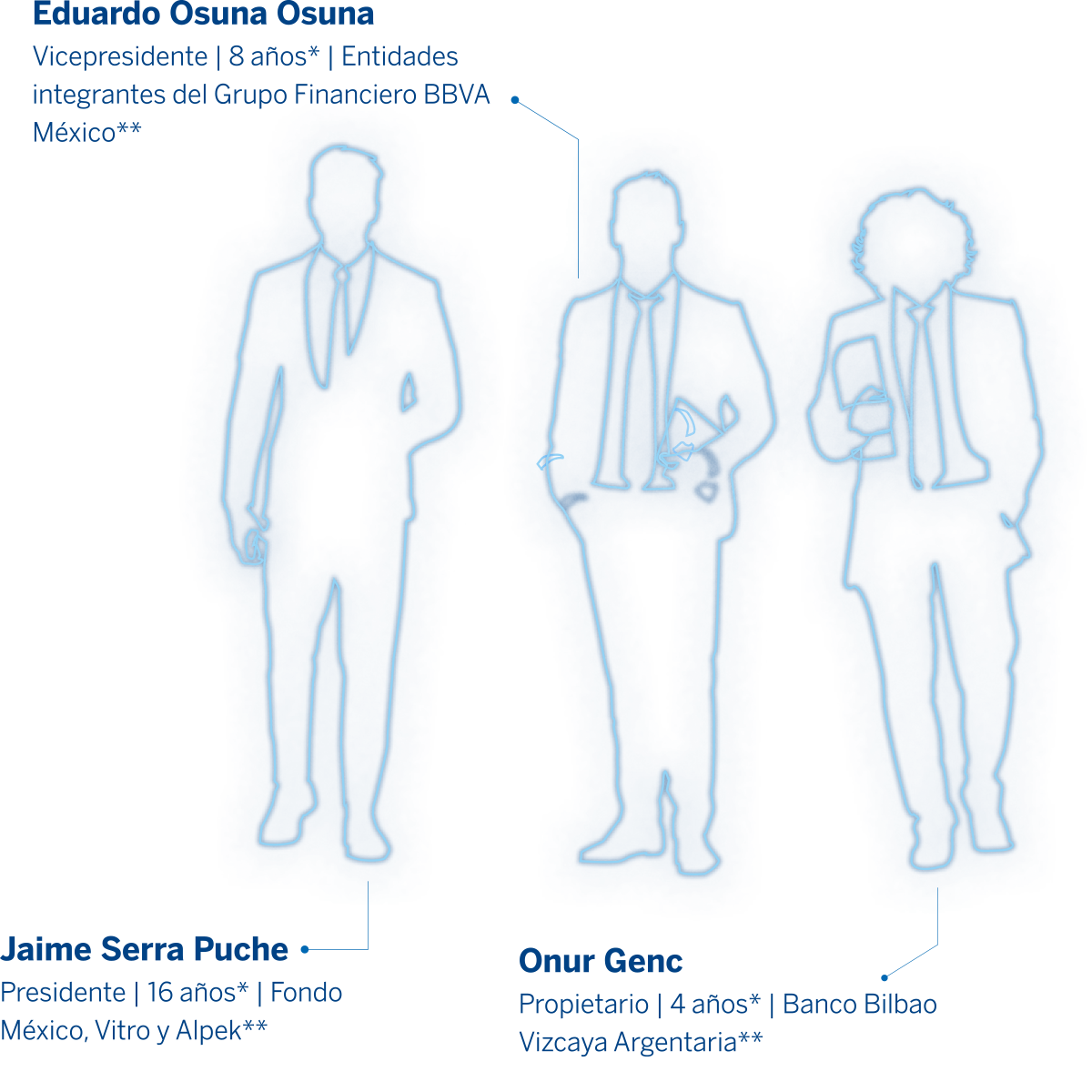

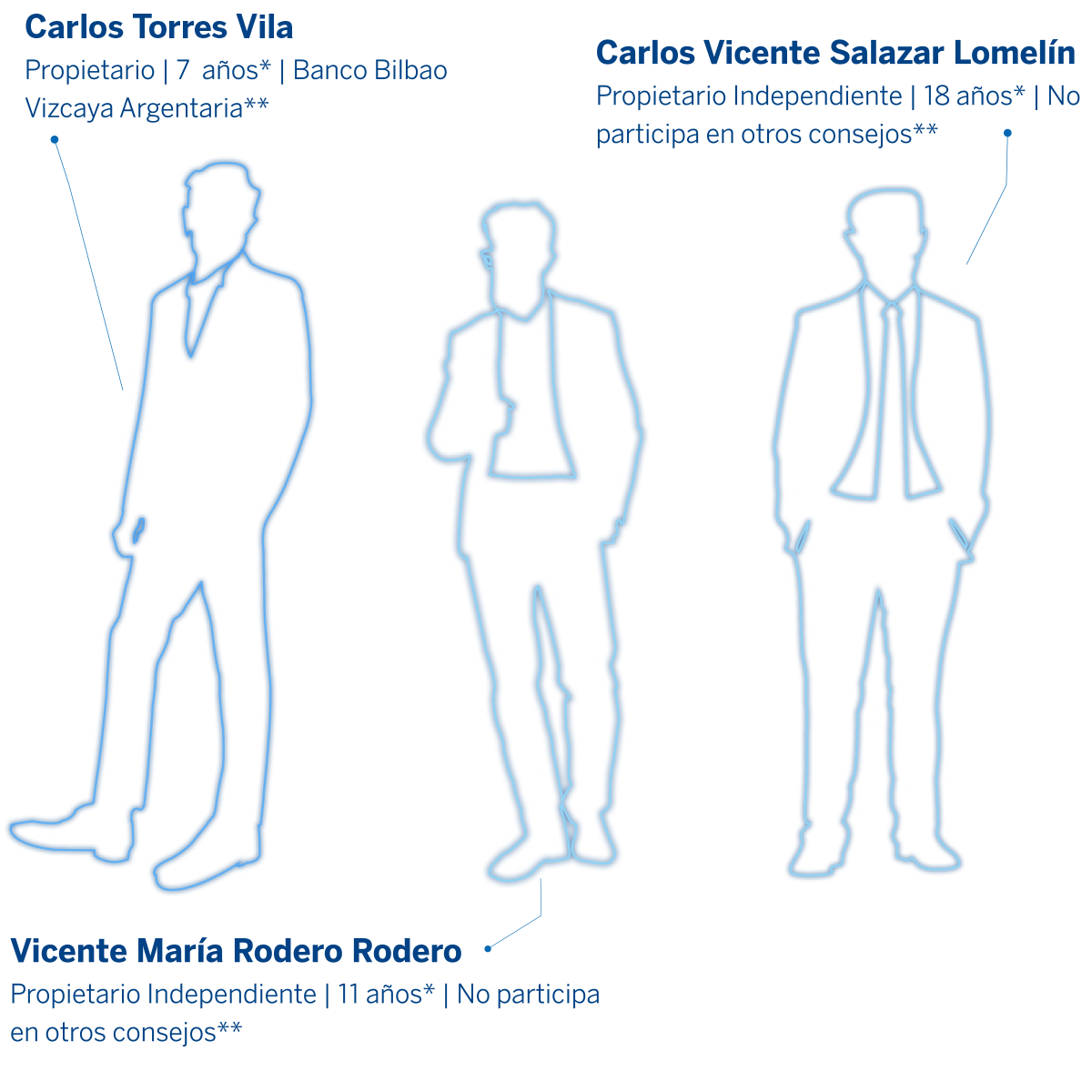

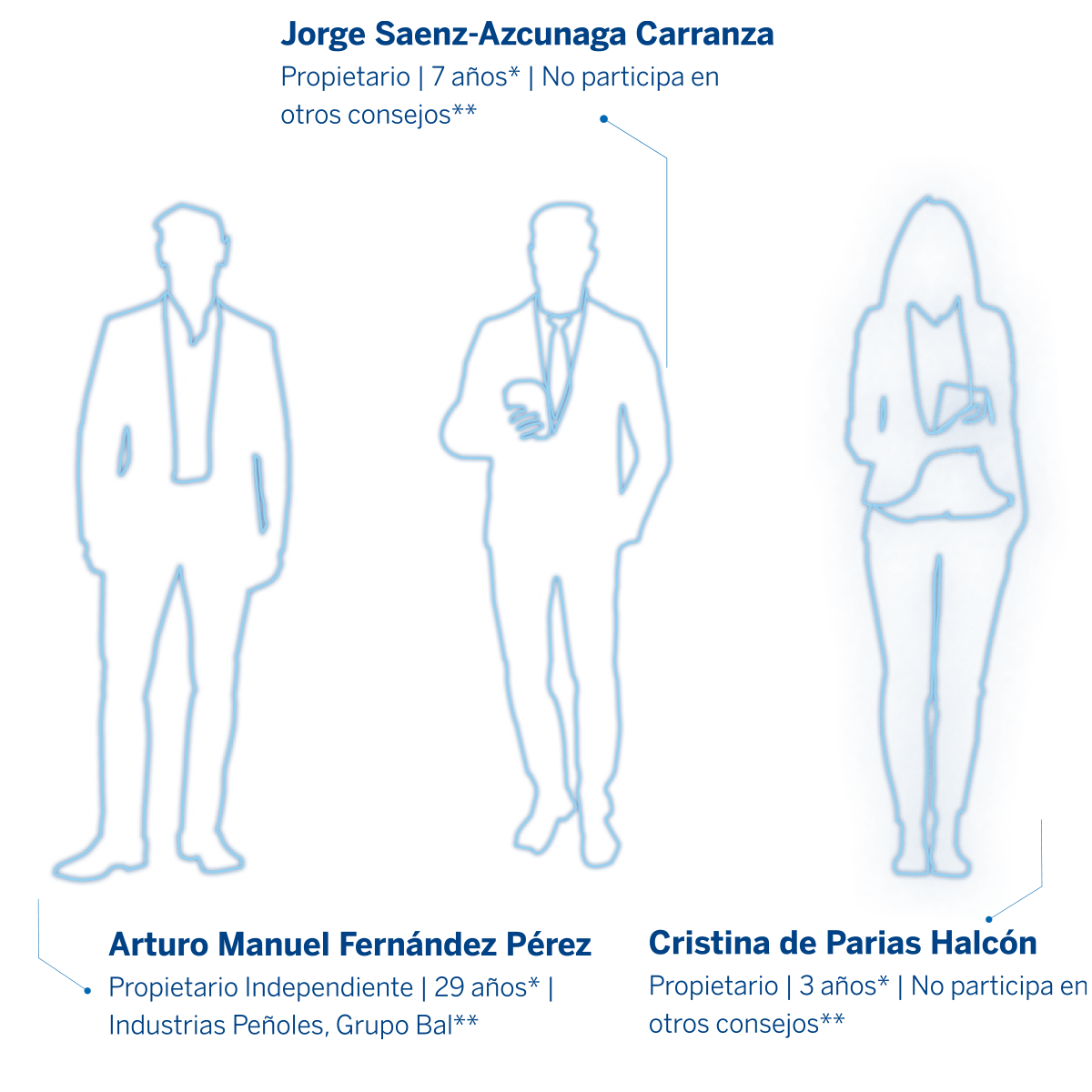

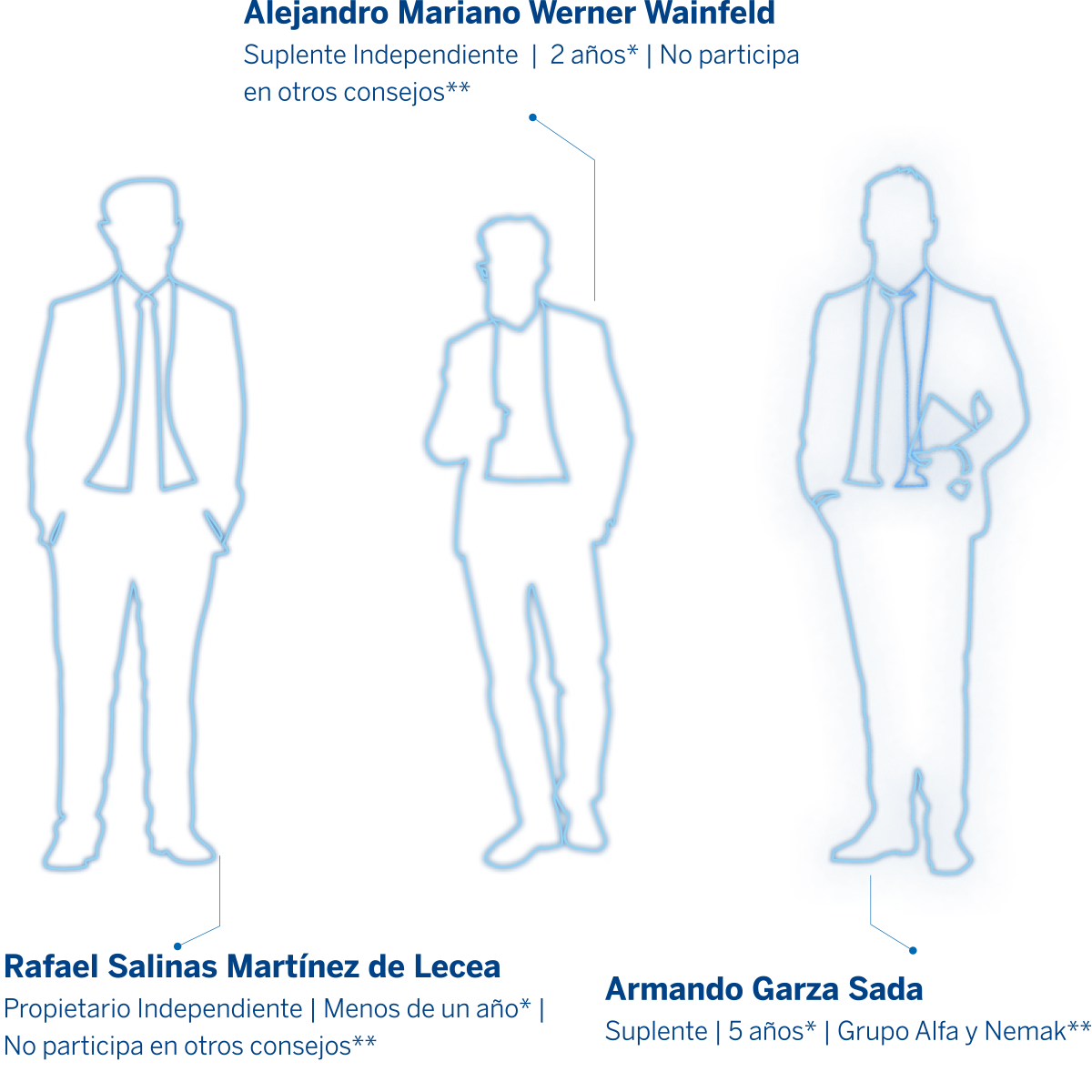

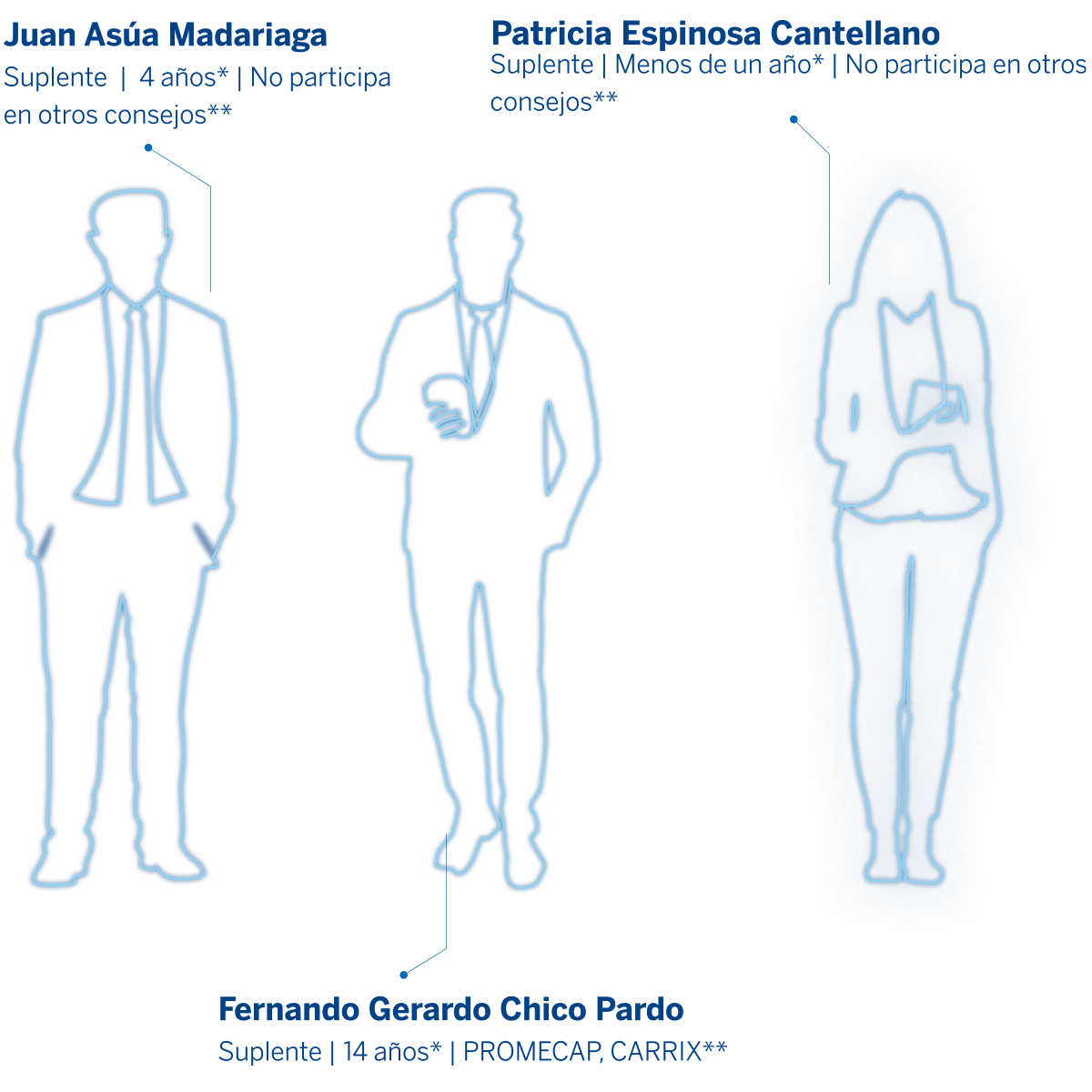

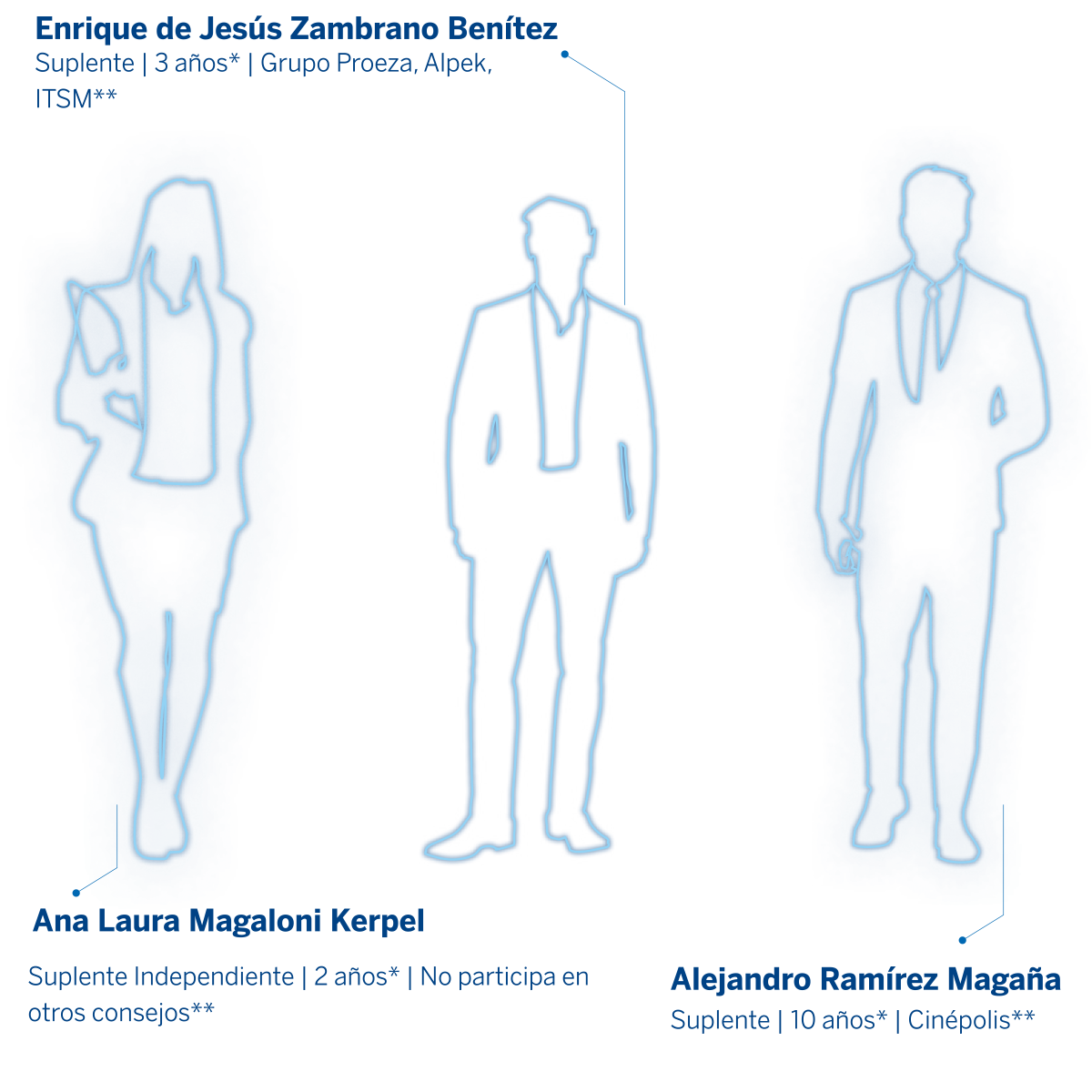

BBVA México’ Board of Directors

The Board is comprised of 18 members and 8 alternates. 7 directors are independent and three are women.

17% of BBVA México’s Board of Directors are women and 83% are men.

Risk management

Organizational structure

BBVA México’s General Risk Department reports directly to the Institution’s General Management, thus guaranteeing its independence from the Business Units and allowing it the necessary autonomy to carry out its activities.

In general terms and considering the best national and international practices, three teams specialized in Credit Risk have been created, the first one targeting the Wholesale portfolio, with the functions of admission, monitoring and recovery. The second team focuses on the SME sector and the last one on the Individuals sector, both with the functions of admission and monitoring. The three teams are supported and complemented by an area dedicated to the management of recovered Non-Financial Assets (NFA).

For the SME and Retail sectors, there is also a specific area that concentrates the recovery functions given the common characteristics and synergies involved in performing the function for these sectors. Also, the management of Market, Structural and Trust Risks are integrated into one Unit, in addition to other units specialized in risk management of non-banking businesses and asset management.

There is also Advanced Analytics, Risk Solutions and Risk Transformation to support the aforementioned units.

The Portfolio Management, Data & Reporting Unit has been implemented for the preparation, monitoring and generation of reports for the management of the areas, as well as for the measurement of operational risk and loss management. This area is also responsible for disclosing information within the Risk area in strict compliance with national and international regulations.

Compliance

Compliance System

The Compliance function is contained in the System and Statute of the Compliance Function of Grupo BBVA México, which consists of a series of elements that together prevent the risks associated with Anti-Money Laundering, Conduct with Clients, Corporate Compliance, which monitors the standards of ethical behavior expected in the Group, the Protection of Personal Data in our possession and the conduct to be observed in the Securities Market.

Integrity Program

For Grupo BBVA México, “Integrity” is a fundamental value in the conduct of its activities and a prerequisite in its relationships with various stakeholders. W Within the institution, it is imperative for everyone to adhere to the Code of Conduct, applicable laws, and regulations in an integral, transparent, and professional manner. This commitment aligns with the social impact of the financial activities conducted by the Group and upholds the trust placed in the Group by its shareholders, clients, and society.

Code of Conduct

BBVA’s Code of Conduct represents an ethical commitment to its main stakeholders, as it seeks to promote principles of upright behavior throughout the organization, to maintain the highest standards of integrity and honesty. Strict standards of conduct are established for the development of Grupo BBVA México’s activities, focused on safeguarding client information in accordance with legal provisions, based on four key pillars:

Conduct with the client

Conduct with our colleagues

Conduct with the company

Conduct with society

In order for everyone to be aware of and understand the importance of the Code of Conduct, all employees of the Group were enrolled. At the end of the three-month course period, accreditation was achieved by 99% of the staff.

Whistleblower and

Consultation Channels

Grupo BBVA provides all its employees with access to the Whistleblower Channel and the Consultation Channel, which remain active and are also available to clients, suppliers, and employees who wish to report any potential breaches of the Code of Conduct, regulations, or practices contrary to the law. These channels are accessible 24/7, 365 days a year.

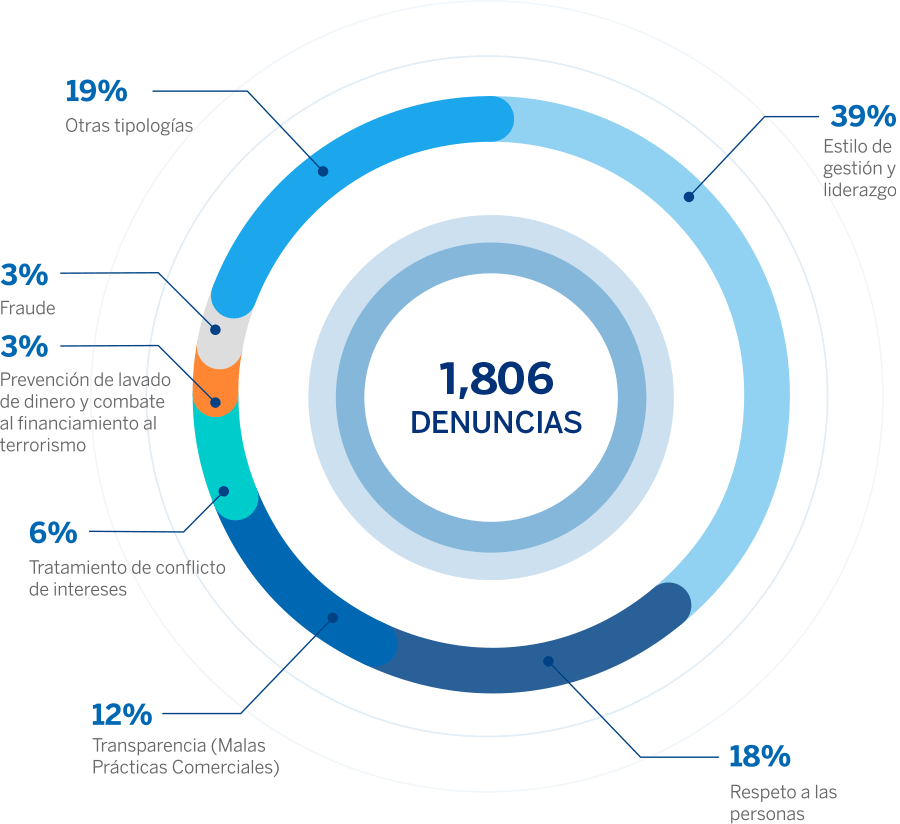

During 2023 we received 1,806 complaints through the Whistleblower Channel, which were classified as follows:

Anti-corruption

The anti-corruption course is regulatory and undergoes updates every three years. It is mandatory for 100% of BBVA México’s workforce to complete this course. When the course is updated, it is distributed to all active employees. In years when updates are not required, it is solely provided to new employees for completion. 2023 was the year when the course underwent an update.

42,816 employees took the Anti-corruption course in 2023.

In addition to the Code of Conduct, BBVA México has clear policies and procedures defined in matters of anti-corruption and economic competition, which are disseminated to all employees through the institutional campaign #Hazlocorrecto (Do the Right Thing).

Anti-Money Laundering and Terrorist Financing

Grupo Financiero BBVA México’s commitment to Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) is a priority objective for the company.

On September 27, the Associates Committee of the ABM approved the best practices that establish the criteria to be considered for a comprehensive international sanctions program; BBVA México has adhered to them. In broad terms, our internal international sanctions program aligns with the requirements outlined in these best practices.

On the other hand, the training of employees, members of the Board of Directors and Executives in AML and CFT includes the disclosure of policies for the identification and knowledge of the client and user, as well as the criteria, measures and procedures for due compliance with the applicable provisions on the subject; the dissemination of the provisions and their modifications.

The evolution of our training in this area is shown below:

|

AML and CFT training |

2021 |

2022 |

2023 |

|---|---|---|---|

|

Participants in AML training activities |

37,967 |

39,565 |

42,969 |

|

Persons who received specialized |

352 |

371 |

384 |

|

Management Committee and Board of Directors |

31 |

31 |

31 |

Human Rights

Due Diligence

In line with the United Nations Guiding Principles on Business and Human Rights, as well as the Global Compact, Grupo Financiero BBVA México seeks to contribute to the comprehensive and sustainable development of the societies where it operates.

In 2023, a due diligence process was carried out under a preventive approach to identify the impacts of operations, as well as the appropriate procedures to repair any damage in case of violation.