Sustainable finance

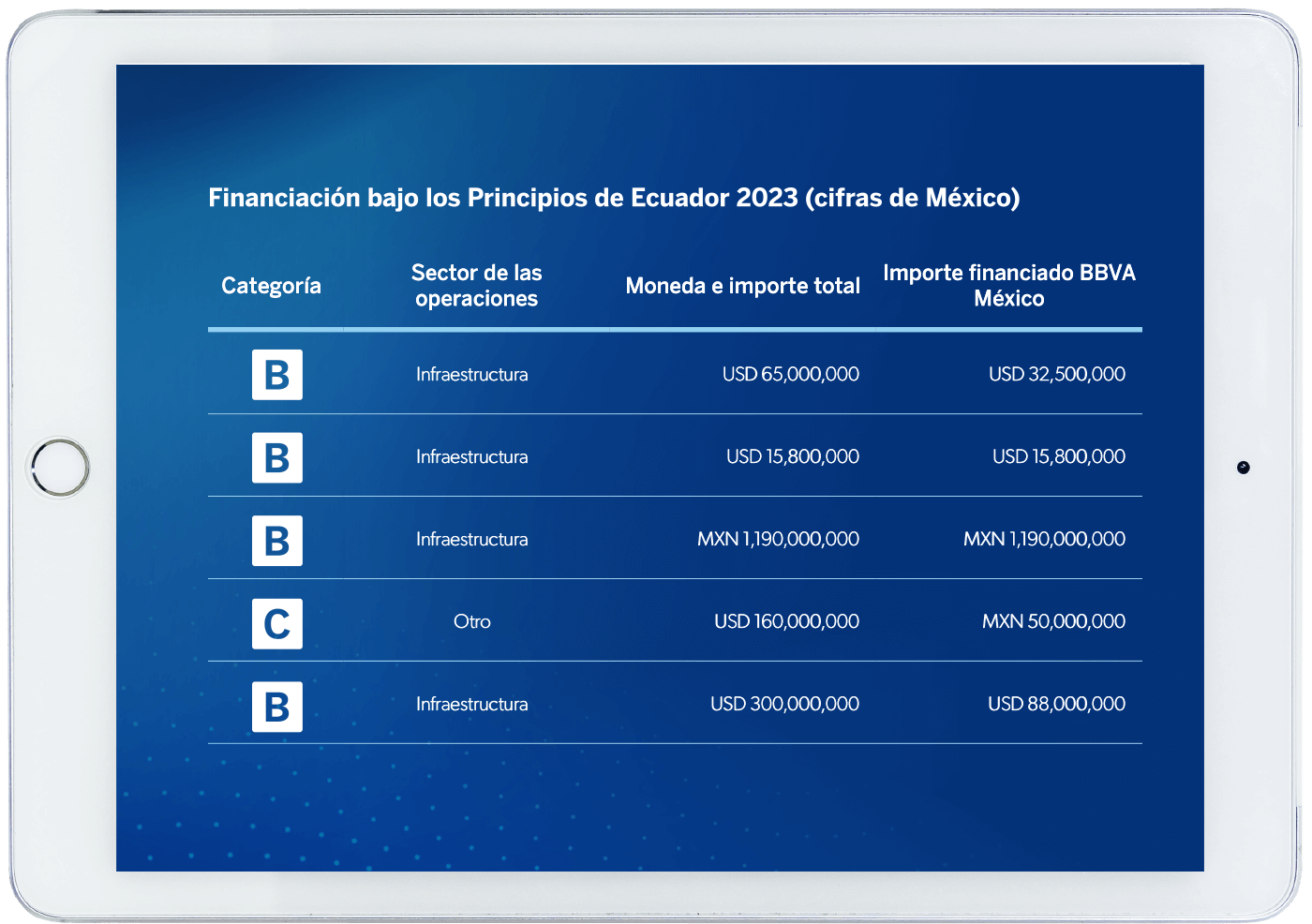

In 2018 Grupo BBVA published its 2025 Goal which consisted of mobilizing EUR 100,000 million in sustainable business between 2018 and 2025. Subsequently, in July 2021 it increased its target to EUR 200,000 million and in October 2022 it increased it again to EUR 300,000 million.

This objective extends to the geographies where the Group operates, including Mexico. As of December 31, 2023, BBVA México channeled3 more than Ps. 206 billion pesos, 29.27% more than in 2022.

3 For the purposes of the Group's 2025 Goal, channeling is considered as any mobilization of financial funds, on a cumulative basis, to activities or clients considered sustainable, mainly in accordance with existing regulations, internal standards inspired by existing regulations, market standards such as the Green Bond Principles, the Social Bond Principles and the Sustainability Linked Bond Principles of the International Capital Markets Association, and best market practices. For the determination of the amounts of sustainable business channeled, internal criteria are used based on both internal and external information, whether public, provided by the clients or by third parties (mainly data providers and independent experts). BBVA assumes no liability for the opinions expressed by third parties or for any errors or omissions in the information from external sources.

Sustainable mobilization 2023, BBVA México 2023

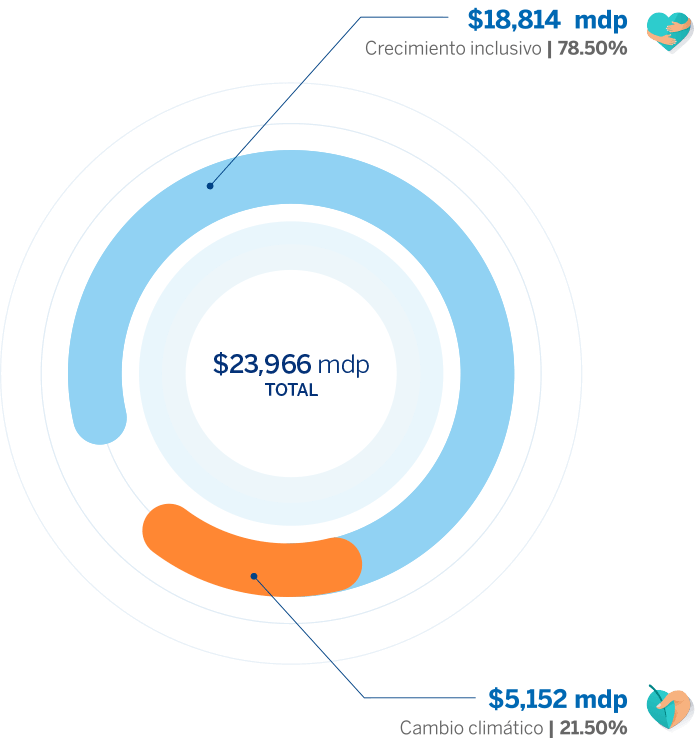

Retail banking

Sustainable mobilization, Retail banking, BBVA México 2023

Inclusive Growth

Financing for the acquisition of mortgages, hybrid and electric cars, SME loans, insurance (cars and mortgages), among others.

Climate change

Financing for the acquisition of mortgages, hybrid and electric cars, SME loans, insurance (cars and mortgages), among others.

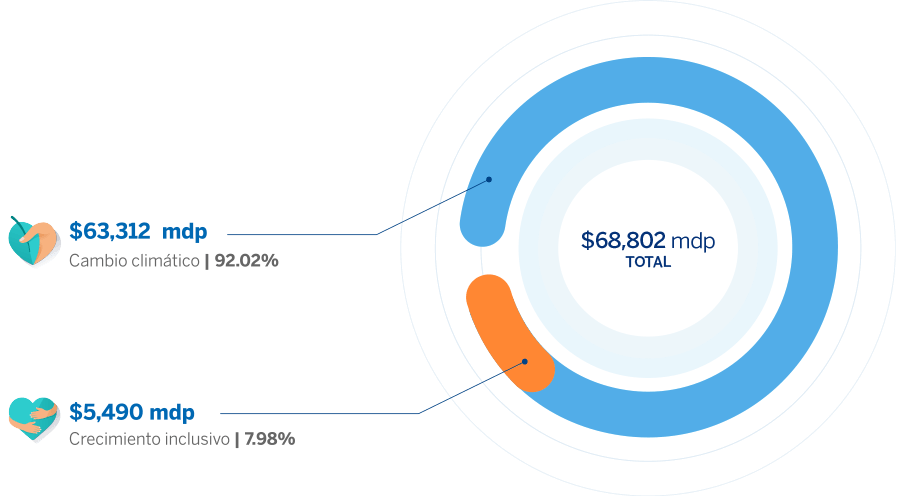

Corporate and government banking

Sustainable mobilization, Corporate and Government Banking, BBVA México 2023

Climate change

Green financing for companies, letters of credit, factoring, leasing, among others.

Inclusive Growth

Financing for companies, letters of credit, factoring, leasing, among others, to promote inclusive growth.

Note: These are products the use of which is accounted for in the sustainable mobilization KPI provided it complies with the BBVA Standard for Financing Sustainable Activities.

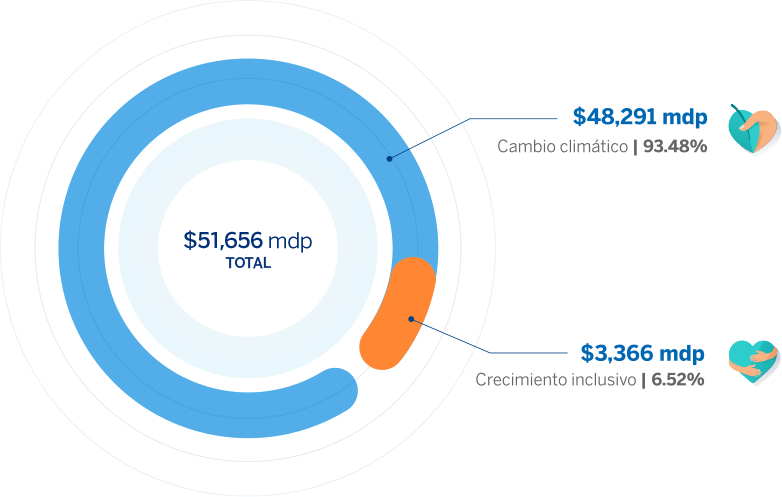

Corporate and Investment Banking (CIB)

Sustainable mobilization, Green and social financing 2023

Climate change

Green financing

Inclusive Growth

Social financing