BBVA México seeks to have a positive impact on the lives of its clients, employees, suppliers, community and society in general, not only through its products and services, but also through programs, alliances and community investment. With its clients, the bank promotes financial inclusion, as well as health and financial education tools and knowledge. Employees develop professionally in safe and diverse work environments. The bank also encourages its suppliers to have responsible practices that contribute to sustainable development. Through Fundación BBVA México, it benefits the country’s most vulnerable communities.

Commitment to our Clients

Seamless experience

BBVA México reiterates its commitment to excellence in customer service, a priority that is maintained year after year, seeking to ensure that each client enjoys a seamless experience. To accomplish this goal, BBVA México provides its employees with the necessary tools and training programs to enable them to offer outstanding service and personalized attention.

Quality and client service

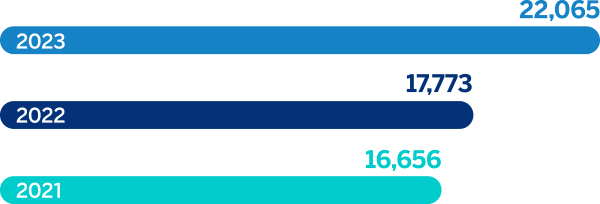

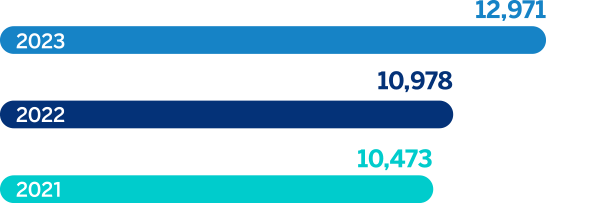

BBVA México uses a client-centric feedback strategy, employing a recommendation index obtained through surveys where clients rate, on a scale of 0 to 10, their willingness to recommend the bank to others. This index is important for the continuous improvement of the bank’s products and services, ensuring that they are closely aligned with the needs and expectations of the clients. The effective use of this tool has allowed us to strengthen the loyalty and trust of our clients, and at the same time gain recognition as one of the most recommendable banking institutions.

Open market recommendation index

In addition to the index that evaluates quality and client service, BBVA México also evaluates how much the general public recommends the bank using the open market recommendation index.

|

Business or channels |

Points above the |

|---|

|

Commercial Banking |

+26.4 |

|

Corporate and Government Banking |

+41.5 |

|

SME Banking |

+1.9 |

|

Telephone Banking |

+10.0 |

|

Mobile Banking |

+20.8 |

|

ATMs |

+24.8 |